SALT / PTE Taxes

Prepaying State Income Taxes

Using the Pass Through Entity tax deduction workaround

* For Updates, Please visit the AICPA Website HERE

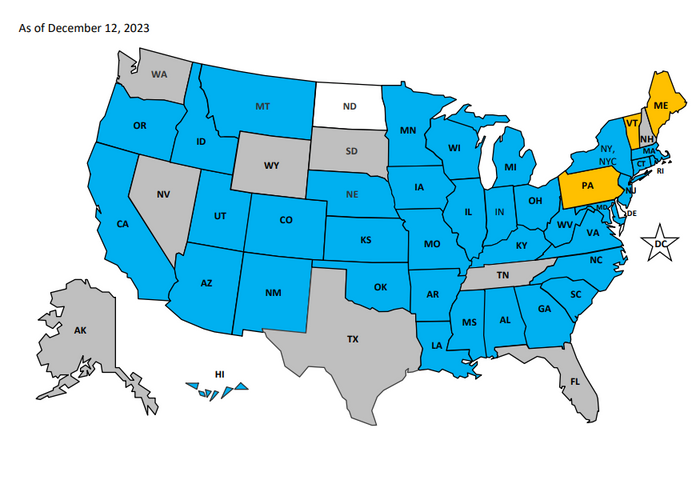

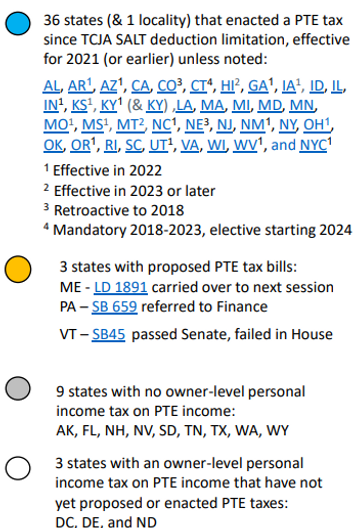

—see bottom of page for list of 36 states that allow this deduction—

Maximizing Tax Benefits: Prepaying Individual Income Taxes Through Pass-Through Entities

The landscape of taxation in the United States has seen significant changes in recent years, particularly with the introduction of the $10,000 cap on state and local tax (SALT) deductions for individual taxpayers. This change has left many seeking alternative methods to maximize their tax benefits and getting a deduction for paying State Income taxes when they are already over the $10,000 limit. One such method is prepaying individual income taxes through pass-through entities, a strategy that has gained traction in several states.

Understanding the SALT Deduction Limit

In 2017, the Tax Cuts and Jobs Act introduced a significant alteration to the SALT deduction, capping it at $10,000. This limit applies to the total amount of state and local taxes that an individual can deduct from their federal income tax. For residents in states with higher tax rates, this cap has led to increased federal tax liabilities, prompting the search for effective tax planning strategies.

The Rise of Pass-Through Entities

Pass-through entities, such as partnerships, S corporations, and certain other business structures, offer a unique tax advantage. The income generated by these entities is not taxed at the corporate level. Instead, it passes through to the individual owners’ tax returns, where it is subject to individual income tax rates.

The Strategy: Bypassing the SALT Cap Through Pass-Through Entities

In response to the SALT cap, several states have enacted laws allowing pass-through entities to elect to pay state income taxes at the entity level. This strategy turns what would be a non-deductible personal SALT expense into a deductible business expense for the entity. The result is a lower federal taxable income for the individual owners.

The Benefits

- Tax Savings: By paying state taxes at the entity level, business owners can deduct these taxes as a business expense, effectively bypassing the $10,000 SALT deduction cap on their individual returns.

- State Compliance: Over 30 states have recognized this strategy and enacted corresponding laws, providing a legal framework for taxpayers to benefit from these arrangements.

- Flexibility in Tax Planning: This approach offers significant flexibility, allowing taxpayers in high-tax states to mitigate the impact of the SALT cap.

Important Considerations

-

State-Specific Rules: Each state has its own set of rules and regulations regarding this tax strategy. It’s crucial to consult with a tax professional familiar with your state’s laws.

-

Eligibility: Not all pass-through entities may qualify for this strategy. The eligibility criteria can vary based on the entity type and state legislation.

-

Potential Federal Response: Taxpayers should stay informed about any federal tax law changes that might affect this strategy.

Conclusion

Navigating the complexities of the SALT deduction limit can be challenging, but the use of pass-through entities for prepaying individual income taxes presents a viable solution for many taxpayers. As with any tax strategy, it’s essential to seek professional advice to understand the implications fully and ensure compliance with both state and federal laws.

Example:

If you’re an Alabama resident and you expect your taxable income to be $100,000, your calculated State income tax would be $5,000 (5% AL tax rate * $100,000 taxable income). If you are the owner of a “pass through entity” like a partnership or an S Corporation, you can have your pass through entity pay State Income taxes on your behalf. Your pass through entity will get a deduction which passes along to you, and you’ll also receive a credit for having prepaid the State income taxes which can be claimed on your individual tax return.

We’ve added the list of 36 states below that currently allow prepayment of State Income taxes along with the individual income tax rate and the applicable state link.

- Alabama: 5% – revenue.alabama.gov

- Arkansas: 5.9% – dfa.arkansas.gov

- Arizona: 4.5% – azdor.gov

- California: 1% to 12.3% – ftb.ca.gov

- Colorado: 4.55% – colorado.gov/tax

- Connecticut: 6.99% – portal.ct.gov/drs

- Georgia: 5.75% – dor.georgia.gov

- Hawaii: 11% – tax.hawaii.gov

- Idaho: 6.5% – tax.idaho.gov

- Illinois: 4.95% – www2.illinois.gov/rev

- Indiana: 3.23% – in.gov/dor

- Iowa: 6% – tax.iowa.gov

- Kansas: 5.7% – ksrevenue.org

- Kentucky: 4.5% – revenue.ky.gov

- Louisiana: 4% – 8% – revenue.louisiana.gov

- Maryland: 8% – marylandtaxes.gov

- Massachusetts: 5% – mass.gov/orgs/massachusetts-department-of-revenue

- Michigan: 4.25% – michigan.gov/treasury

19. Minnesota: 9.85% – revenue.state.mn.us

20. Mississippi: Variable – dor.ms.gov

21. Missouri: 5.3% – dor.mo.gov

22. Montana: 6.7% – mtrevenue.gov

23. Nebraska: 5.5% – revenue.nebraska.gov

24. New Mexico: 5.9% – tax.newmexico.gov

25. New Jersey: Up to 10.9% – state.nj.us/treasury/taxation

26. New York: Up to 10.9% – tax.ny.gov

27. North Carolina: 4.99% – ncdor.gov

28. Ohio: 5% – tax.ohio.gov

29. Oklahoma: 5% – ok.gov/tax

30. Oregon: 9% – 9.9% – oregon.gov/dor

31. Rhode Island: 5.99% – tax.ri.gov

32. South Carolina: 3% – dor.sc.gov

33. Utah: 4.85% – tax.utah.gov

34. Virginia: 2-5.75%- tax.virginia.gov

35. West Virginia: Up to 6.5% – tax.wv.gov

36. Wisconsin: Up to 7.65% – revenue.wi.gov